Subscribe to stay ahead with expert insights on ESOPs, smart ownership strategies, and more!

Editor’s Note How much equity to give early employees is one of the most difficult early decisions, and this article helps founders and business leaders make it. It provides a balanced perspective that puts long-term scalability, growth, and fairness first and is supported by actual benchmarks and valuation of a company.

Few decisions are more difficult than determining how much equity to give your first workers in the early stages of a firm. Equity is a sign of trust and collaboration rather than just a means of pay. Early hires behave and think like founders when they own a portion of the private equity company.

For many businesses, the only way to draw in top people and save money is to provide equity options for employees. However, determining the appropriate amount requires strategic thinking to avoid handing out too much power or undervaluing future contributions.

There’s no single formula for deciding equity splits, but certain variables consistently shape those decisions:

Since the valuation of a company is lower during the seed or pre-seed stages, each ownership percentage is more significant. At this stage, founders typically give the employee pool 10% of the entire shares.

Employees who join before revenue or product-market fit are taking a significant risk. While subsequent recruits might receive 0.1–0.3% of equity, early engineers, designers, and product leaders typically receive 0.5–1%.

Equity frequently determines whether a candidate would answer "yes" or "no" in competitive areas like tech and SaaS.

With every investment round, your assessment of the business will vary. To ensure equitable rewards over time without continuously expanding the pool, plan your pool size with dilution in mind.

Although each business is different, data provides helpful safeguards. A 2023 research by the U.S. Bureau of Labor Statistics found that, depending on position, seniority, and funding stage, early employees (the first ten hires) in growth firms usually own 0.1–1% of the total business equity.

Since their labor directly affects product development and investor preparedness, founding engineers or important technical recruits typically receive the higher end of that range. Smaller but still significant allocations are frequently given to non-technical early recruits, such as HR or operations.

Structure is important once you've decided who gets what. While adhering to local laws, your equity options for employees for a startup should strike a balance between fairness and motivation. What to lock in is as follows:

This procedure can be automated with the aid of an organized ESOP Management Plan , which reduces human error and maintains the cap table's transparency.

A private equity firm or venture investor evaluates discipline in addition to numbers when they look over your cap table. Early equity grants that are too large can give the impression that your firm is poorly run, while those that are too small can make it harder to draw in top people.

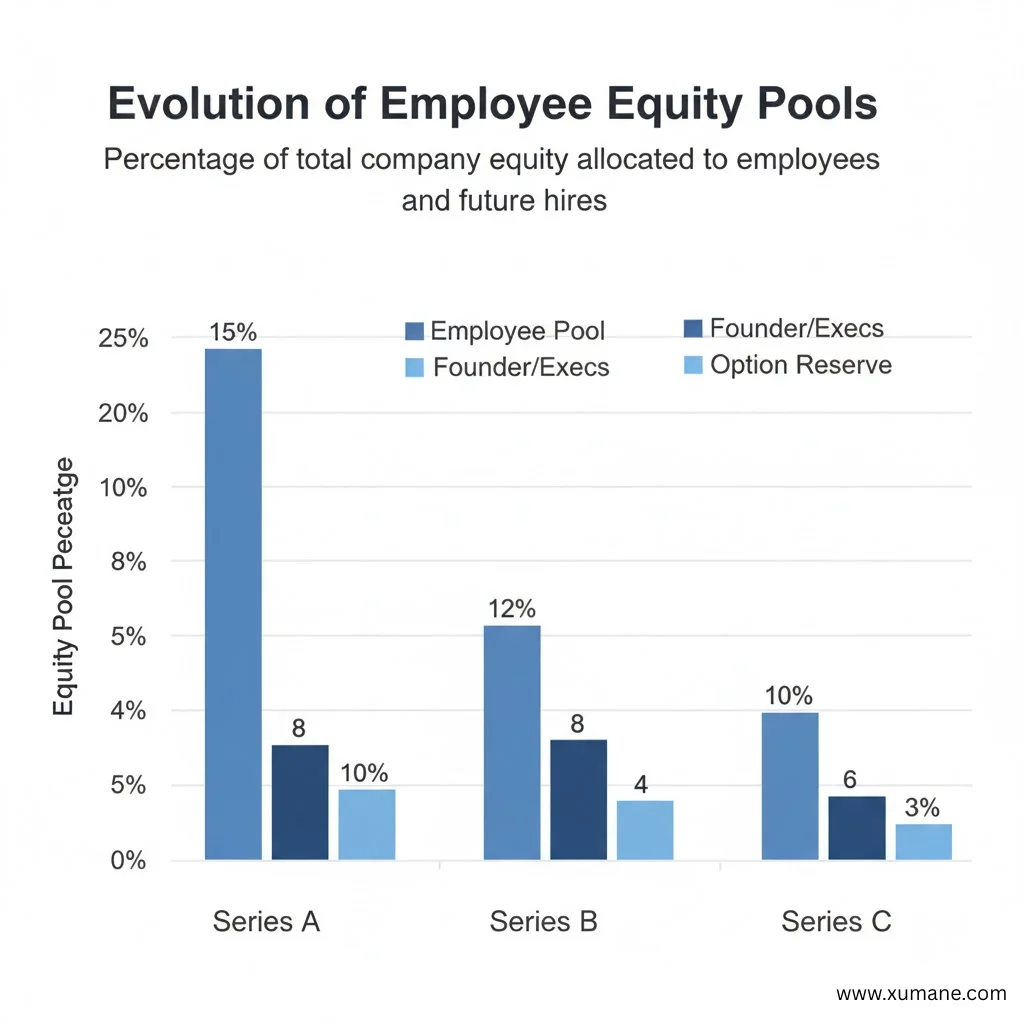

The most popular amount for an employee option pool is between 10% and 15% of total private equity company stock, with 10% being the most popular option, according to HSBC Innovation Banking's 2025 Term Sheet Guide. Whether the pool is determined pre-money or post-money, this standard remains valid.

By rewarding early hires while preventing future dilution, maintaining a balanced pool shows investors that you're considering growth and retention strategically. It's one of the most obvious indicators that a founder is knowledgeable in long-term capitalization planning and ownership dynamics.

Equity is not a natural concept. Many workers find it difficult to see how their choices could result in financial success. They should be guided through basic models by the founders, such as "If we exit at ₹100 crore, your 0.5% equals ₹50 lakh before taxes."

Employees feel more invested in the mission and the numbers when there is this level of transparency. Additionally, it guarantees that expectations stay reasonable after several investment rounds and dilution occurrences.

Giving fairness is about congruence, not generosity. Teams are inspired to work harder, stay longer, and think like stakeholders when they have the proper framework. When done incorrectly, it can lead to misunderstandings and animosity.

Consider equity as a tool for governance as well as a reward. Strike a balance between transparency, sustainability, and fairness. Equity is ultimately the cornerstone of your culture rather than merely a component of your business.

Early employees usually land somewhere between 0.1 and 1 percent, depending on role, risk, and timing. Your first engineers or product leaders often sit near the top of that range because their work shapes the entire company. Non-technical but critical early hires tend to receive smaller, but still meaningful, slices. Most founders set aside a 10 percent pool for the whole team at this stage.

Most startups use a four-year vesting schedule with a one-year cliff. The cliff gives both sides time to confirm the fit before any equity vests. After that first year, vesting usually happens monthly. It keeps people aligned with the company’s longer arc rather than just the next few months.

Yes. Every funding round expands the cap table and reduces everyone’s percentage ownership, including employees. What this really means is that the value of their shares should grow as the company grows, even if the percentage itself shrinks. Dilution isn’t a flaw in the system; it’s part of how companies raise capital and scale.

Keep it simple and concrete. Walk candidates through basic scenarios instead of throwing jargon at them. For example, if the company exists at 100 crore and they hold 0.5 percent, here’s what that looks like in actual money before taxes. The clearer you are about vesting, dilution, and possible outcomes, the more confidence people will have in your offer.

No. Equity should track impact and risk, not headcount order. Someone joining before revenue or product-market fit is taking a different leap than someone who joins after traction is clear. Think about role criticality, timing, and the competitive talent market. Fair doesn’t mean equal; it means consistent and well-reasoned.