Subscribe to stay ahead with expert insights on ESOPs, smart ownership strategies, and more!

Esitor's Note:- Hi there, Xumane fans! Our first goal is to make the murky waters of equity absolutely clear.

Money for private equity? They are similar to the high-octane engines that drive some of the most prosperous business endeavors.

In this blog, we're sharing the complete process of how these funds are created, together with data, tales from the real world, and guidance to provide investors, founders, and dreamers the full picture. Whether you want to grow your company or enter into the private equity sector, this blog can help. Let's get going now!

Ever wonder how a chemical firm gets a multi-billion dollar makeover or how a tenacious startup like Lyft soars to a $22 billion valuation? Private equity funders, the financial gurus who see potential, throw money in, and turn enterprises into gold, are responsible for that.

However, what is the key to their success? To make sense of it all, let's dissect the structure of private equity funds, add some anecdotes from real life, and add some statistics. It will be an exciting ride. Read on!

So, What's a Private Equity Fund?

Think of a private equity fund as a high-stakes poker game where players bet on companies with significant potential, and the chips are worth millions of dollars. These funds combine capital from wealthy investors, pension funds, university endowments, or individuals with substantial financial resources to purchase, restructure, and sell private businesses. These transactions target businesses that are not well-known to the general public with the intention of flipping them for a healthy profit, unlike equities that you may trade on your phone.

The private equity sector is blazing, as seen by the prediction that assets under management will jump from $540 billion in 2024 to an incredible $1.7 trillion by 2033. Why all the excitement? Private investment firms are skilled at finding underdogs and turning them into winners. Let's see how they pull it off.

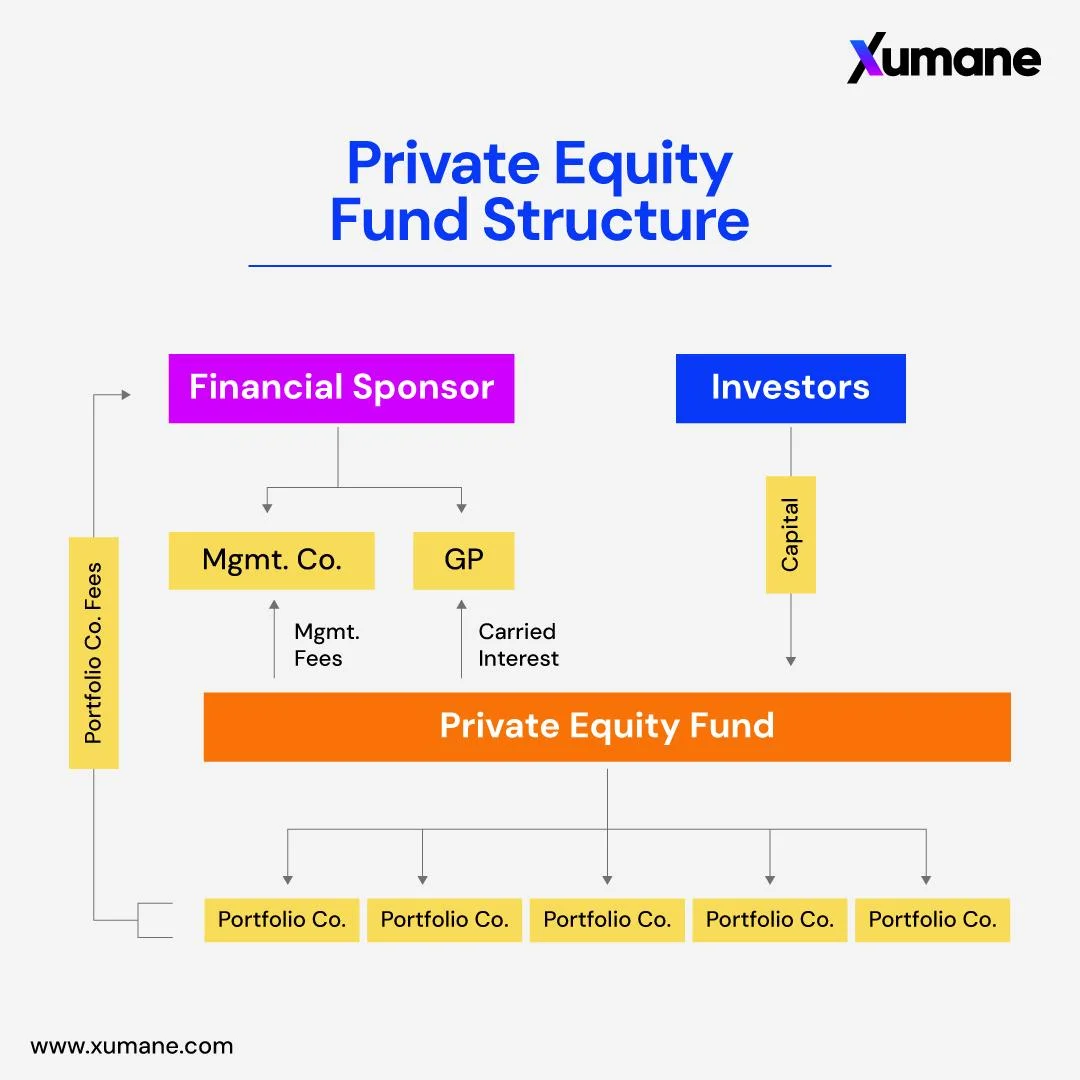

Every member of a private equity fund plays a crucial part, much like in a rock band on tour. With a contract known as the Limited Partnership Agreement (LPA) serving as the framework, the majority of funds are organized as limited partnerships (LPs) or LLCs. This person is on stage:

GPs are the rock stars of the fund for the private equity firm itself. They:

Generally speaking, GPs contribute between 1% and 3% of the fund's assets to show that they are doing more than just talking. Because they might be held responsible for any legal problems, it's a hazardous strategy. Consider Apollo Funds securing a 2023 deal for the chemical firm Univar worth $8.1 billion . They reimagined the business like experts, demonstrating that GPs are the real thing.

GPs commit 2–5% of capital, source and manage deals, and earn fees plus carried interest.”

LPs are the big spenders in the crowd, ponying up 97-99% of the cash. They’re pension funds, universities, or mega-rich folks who:

Say a pension fund throws millions into a PE fund to spice up its portfolio, hoping for returns that crush the stock market.

The fund is where the magic happens, a legal entity that holds the cash and follows the LPA’s rules. It spells out:

Funds usually stabilize for 10-12 years, with a 3-5-year sprint to buy companies and a longer stretch to grow and sell them.

The management company is the crew making sure the show runs smoothly. They handle:

Private equity funds play by the “2 and 20” rule:

This setup lights a fire under GPs to deliver, but some grumble that fees can nibble away at investor wins, especially if the fund’s a dud.

In a 2017 private equity round, Lyft raised $600 million , estimating its worth at $7.5 billion. By changing operations and adding new cities, private equity companies strengthened their fight against Uber. Investors received a huge payout when Lyft went public in 2019 with a valuation of $22.2 billion. It's a timeless story of PE making dreams come true.

Not every fund is the same. Take a quick look:

Each type fits different risk appetites and reward goals.

Investing in private equity funds is like betting on a dark horse.

Apollo Funds paid $8.1 billion to acquire Univar, a chemical company, in 2023. They turned Univar into a profitable machine by streamlining supply chains and forming powerful alliances. This project demonstrates how private equity firms work their magic.

Private equity is about spotting potential where others see problems and building something epic.”

The rock stars of finance are private equity funds, which combine money, talent, and courage to produce huge successes. Every component of the private equity fund structure works together to make it happen, from GPs spearheading the initiative to LPs financing the vision.

We, at Xumane, are your go-to people for anything equity-related. Managing cap tables, vesting schedules , and investor announcements is simple and quick. The platform boosts your equity game with ease and transparency, much like private equity funds do for firms.