Subscribe to stay ahead with expert insights on ESOPs, smart ownership strategies, and more!

Editor's Note:-If you ask any founder about a decision they wish they could undo in their journey, most often, it’ll be letting a high-potential individual slip away. That’s a heavy regret!

The good news is that there are ways to avoid that. A Long-Term Incentive Plan (LTIP) can help you retain your best talent by aligning their growth with your company’s future. Keep reading to find out everything about LTIPs and how they’re your best bet for long-term talent retention.

It’s not surprising that 33% companies say they offer Long-Term Incentive Plans (LTIPs) to attract and retain employees.

Think about it.. Take a moment and reflect on what would keep you at a company. Something that makes you think twice before you accept another offer.

For many, it is the opportunity to build wealth .

And that’s where Long-Term Incentive Plans (LTIPs) come into the picture.

So yes, being invested in the company for the long haul calls for some long-term incentive!

LTIPs are compensation plans that reward employees for their performance, loyalty, and dedication over time (No, not immediate!). Their motive? To align employee benefits with the company’s growth vision for, typically, a 3-5 year period.

Let’s understand LTIP via an example.

So let’s assume you’re a mid-level manager at a rapidly growing startup. You’re getting a salary package, and you’re also getting performance-based ESOPs.

The granted ESOPs vest over 4 years with a 1-year cliff period . Every year, you earn a portion of your ESOPs (once you’ve achieved the required performance).

Now, when an employee has ESOPs that will take 4 years to fully vest, this acts as a strong persuader that tempts the employee to stick with the company for longer.

This is LTIP in action!

But, Who Gets LTIPs?

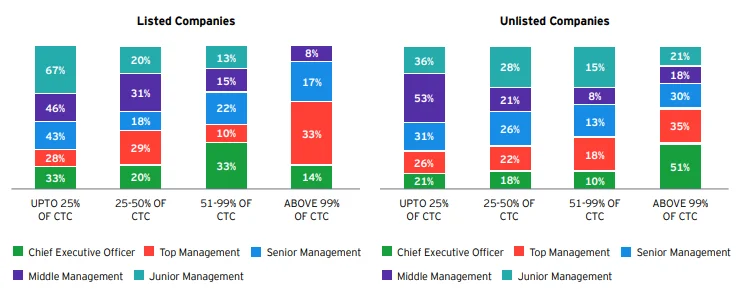

LTIPs are usually reserved for the top management, but many companies also extend them to other levels, depending on how critical or high-impact the roles are. The value of the incentive usually reflects the value the employee brings to the company.

By EY India, showing what percentage of annualized CTC an employee is getting as per their internal levels.

Source:Ey

Let’s look at the most common types of LTIPs.

RSUs commit to employees that they will receive company shares at a later date, upon meeting certain pre-defined conditions. They do not offer immediate ownership. Once vested, employees have the option to sell or transfer shares.

The employee stock options are gaining popularity in the startup world. ESOPs grant employees ownership in the company by offering company options that they can choose to exercise (usually at a lower price than the market value) after vesting.

Phantom stock options grant the right to get a cash payment equal to the appreciation of the company stock. These shares do not dilute equity, which is why they are a hit with the founders and shareholders.

These are shares awarded based on achieving key milestones. This serves as a strong motivator for employees, as eligibility is tied to achieving specific targets or outcomes.

These are cash incentives that are paid after a pre-defined period. These types of LTIPs are popular among private companies and act as an immediate reward for consistently achieving set performance metrics.

A profit-linked incentive (PLI) is a financial scheme where incentives are provided to the employees based on their measurable performance or output, typically tied to increased sales, production, or revenue, resulting in higher profits. These programs are typically assessed via transparent metrics (company profit, departmental targets, or individual KPIs).

With that out of the way, let’s dive deeper to understand how LTIPs work.

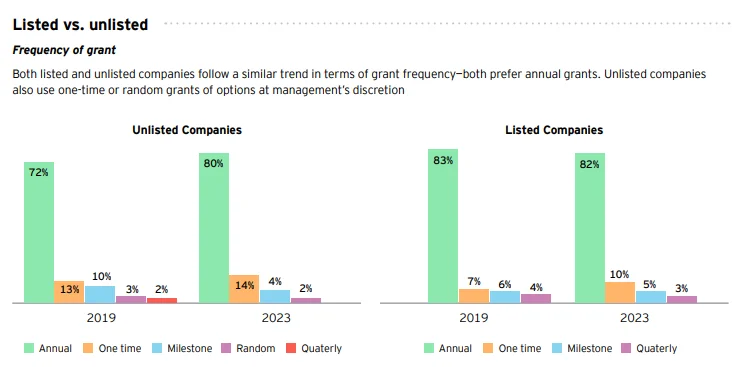

Source:Ey

The above image displays how frequently LTIPs are granted across listed and unlisted companies.

They can be annual, one-time, milestone-based, or entirely discretionary!

LTIPs are promised today but usually paid out over time, as per the vesting schedule. The vesting period, which is predetermined, is commonly of 3-5 years.

The purpose is to encourage employees to stay with the company for a longer period and also align their performance with the company’s long-term goals. If an employee leaves before vesting, the unvested incentives are forfeited.

Payouts depend on the type of LTIP.

Equity-based plans like ESOPs, RSUs, and performance shares offer company shares that employees can either exercise (purchase) or get as direct grants.

On the other hand, cash-settled plans like phantom stocks, SARs, and deferred bonuses offer cash payout depending on how the company’s performance metrics are and how the employee has contributed to the company’s growth.

In high-growth companies, payouts may also depend on liquidity events such as an IPO or an acquisition.

And that’s how LTIPs work!

Now let’s move on to the taxation part of this.

Taxation on LTIPs varies depending on the type of LTIP extended.

If it’s about ESOPs, these are taxed at 2 different events. They are once taxed at the time of exercise (as salary income, as per the applicable slab rate) and then taxed when the employee decides to sell these shares (as capital gains tax).

RSUs and performance shares are taxed as income from salary when they get vested (as per the market value on the vesting date).

Phantom Stocks or SARs are also taxed as perquisite income when paid out (as per income tax slab on salary income).

Just like appraisals are expected, long-term incentive plans are expected today. Employees are negotiating not just on cash but also on these LTIPs.

They are a solid tool for building mutual commitment. They act as a sure-shot hook for retaining and motivating employees.

So, if you’re an employer, you ignore LTIPs anymore, and if you’re an employee, be sure to evaluate the real value of what you’re being offered. Good luck!

The most common types of LTIPs are stock options (ESOPs), restricted stock units (RSUs), performance shares and cash-based incentives.

Eligibility criteria varies depending on the company's discretion. However, senior executives and employees in critical roles are usually eligible to be offered LTIPs. The benefits usually have a vesting period along with tenure and key performance criteria.

LTIPs reward employees for achieving long-term goals of the company. Since LTIPs vest over time (usually 4 years), employees are bound to stay at the company while putting in their best efforts to get benefits of the LTIP offered to them.

Short-term incentive plans (STIPs) reward employees over a year or less for their performance. While LTIPs reward employees over 3-5 year period based on achieving key business milestones and performance.

LTIPs help companies attract top talent while retaining them for the long term. This way, companies get to keep talented folks with them for longer while empowering the employee to create significant wealth apart from their salary.

Of course! Startups are usually low in cash and LTIPs help startups to attract and retain high-talent individuals in lieu or promising growth. LTIPs like ESOPs and performance shares are quite common in startups.