Subscribe to stay ahead with expert insights on ESOPs, smart ownership strategies, and more!

Editor’s Note:- The purpose of this article is to make the reverse flipping concept easier for investors, employees, and founders. Consult experts before carrying out share swaps, restructurings, or mergers because cross-border corporate structures involve legal and tax complexities. Consider this guide to be insightful rather than legal advice.

The startup idea was pretty straightforward a few years ago. Raise money in dollars, incorporate overseas, and expand internationally. Indian entrepreneurs flocked to foreign jurisdictions, such as Singapore, Delaware, and Cayman, because they believed these jurisdictions offered them faster investor confidence, cleaner corporate structures, and better access to fundraising.

However, the story has started to quickly shift.

Reverse flipping is the process by which an increasing number of Indian startups are returning to India. Additionally, this change isn't motivated by hype like the previous trend was. Policy changes, investor expectations, cost advantages, and an unexpectedly sentimental motivation, i.e., founders' desire for their businesses to once again have an Indian home base, are the main drivers.

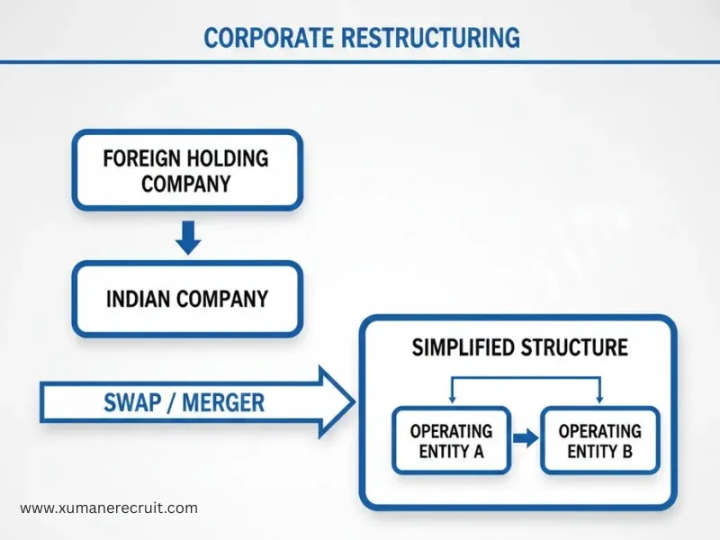

The process of moving a startup's parent company back to India by giving a newly established Indian entity ownership of an overseas holding company is known as reverse flipping.

The majority of reverse flips use a share swap or stock swap structure, in which current shareholders swap their foreign shares for Indian company shares, rearranging the cap table without exchanging cash.

Although it sounds complicated, the concept is straightforward. Your multinational corporation becomes legally, structurally, and financially Indian once more.

The motivations are financial, strategic, and emotional in addition to regulatory.

For many years, especially during the 2015-2020 boom, investors favored offshore entities, so many startups incorporated overseas. However, an intriguing development occurred in 2023.

Funding for venture capital (VC) in India showed resilience and recovery, reaching $13.7 billion , 1.4 times the levels in 2023. India is now the second-largest VC destination in Asia-Pacific thanks to solid domestic fundamentals, progressive regulatory changes, and growing public market activity.

Just this change altered the discourse. Indian entities now feel like a strength rather than a disadvantage.

Another dynamic is the maturation of India's regulatory environment. It became easier to predict compliance. Friction was decreased by startup-friendly circulars.

India introduced more than 50 major regulatory reforms between 2016 and 2023.

This improved ease of doing business and made reverse flipping far less intimidating.

A psychological change is taking place.

Since foreign entities frequently cannot list directly in India, reverse flipping becomes the way to make this possible.

Over 35Indian startups with foreign holding structures explored India listing feasibility in 2022-23.

IPO dreams are no longer pointing outward. They’re pointing home.

Depending on the complexity of the shareholding, reverse flipping is typically carried out using one of the following structures:

Each route has different FEMA, RBI, and Income Tax implications , so companies select the structure based on cap table maturity, investor jurisdiction, ESOPs, and existing agreements.

Several reasons:

India’s corporate ecosystem has become far more predictable. The MCA portal improvements alone reduced compliance turnaround times significantly.

Indian VCs increasingly prefer local structures to avoid FEMA complexities.

Employees in India often face tax complications if their parent company is offshore; reverse flipping fixes that.

Companies like Zomato, PolicyBazaar, Nykaa, and MapMyIndia have proved that domestic listings can deliver strong visibility and liquidity.

Many founders simply want their HQ in the market they’re building for.

It’s not required legally. It’s not required financially.

It’s just a cultural aspect.

It's not always easy to reverse flip.

Businesses need to manage:

Clarity is important in this situation. After years of SAFEs, notes, and investor entries, some cap tables become disorganized across jurisdictions. To ensure that no shareholder is at a disadvantage, share swaps must be carefully coordinated.

This is where the narrative starts to get interesting.

When an Indian parent company handles ESOP taxation, share certificates, compliance inquiries, and long-term liquidity, employees frequently feel more secure. Because contract law, employment law, and HR frameworks are brought into line with the real working jurisdiction, reverse flipping also enhances communication.

Additionally, investors are beginning to view India as a long-term growth market that is worthwhile.

What about the founders?

Bringing the business "home" is seen by many as the culmination of a cycle, a return to the company's roots with greater maturity and focus.

Reverse flipping is a correction rather than a trend.

Startups no longer need to look overseas for legitimacy as Indian capital markets expand, laws change, and domestic investors become more powerful.

This is where they can scale, grow, raise, and list.

The route is made legally feasible by share swaps, stock swaps, and hybrid structures. It is emotionally potent because of the founder's conviction, the maturity of the policies, and the alignment of the employees.

Reverse flipping is an indication of confidence in India as a long-term home, an investment market, and a startup ecosystem.

It’s the process of shifting the parent company back to India from an overseas jurisdiction, usually through a share swap or merger.

Easier compliance, Indian investor preference, IPO readiness, tax clarity, and sentiment.

It’s when shareholders exchange their foreign shares for Indian company shares during the restructuring.

It depends on valuation, number of shareholders, jurisdictions involved, and legal complexity.

Yes, in fact, reverse flipping is often done specifically to enable Indian listings.