Subscribe to stay ahead with expert insights on ESOPs, smart ownership strategies, and more!

Editor's Note:- One of those business procedures that most founders don't consider until it's necessary is share cancellation. This article explains in simple terms what it means, when to use it, and how to do it correctly in accordance with Indian legislation. It is intended for business secretaries, finance leads, and startup founders who require a concise explanation free of legalese.

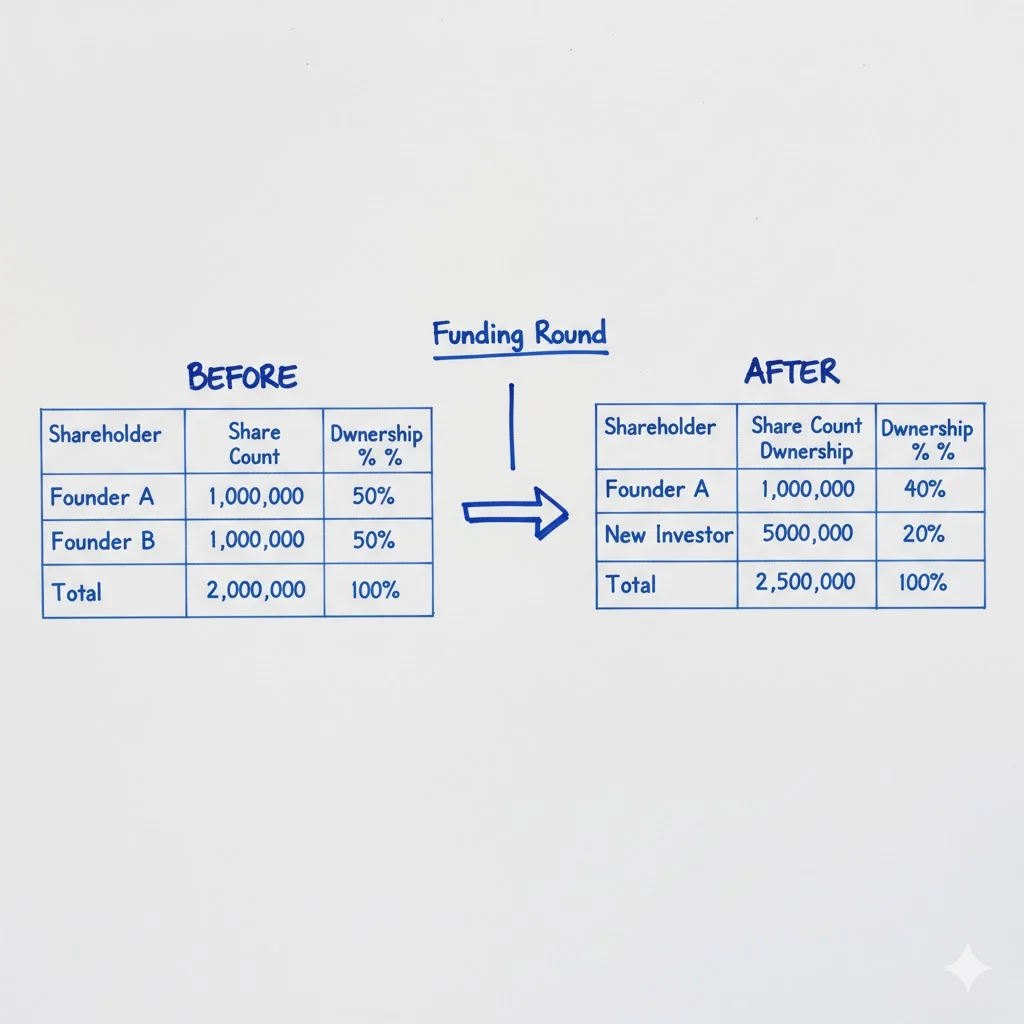

Ownership is represented via shares. However, as businesses change, whether through fundraising, reorganization, or the clearance of outdated documentation, shares must frequently be cancelled. According to Indian corporate law, shares that were never issued or that the firm has chosen to buy back and extinguish are permanently removed from circulation through a formal process.

When executed properly, share cancellation indicates sound governance, enhances ownership clarity, and keeps your books thin. If done incorrectly, it may result in tax and legal issues.

This is a thorough explanation of what share cancellation actually entails, how to deal with it in India, and what to avoid.

Share cancellation: what is it? It involves taking a company's shares out of circulation forever. They can't be sold, transferred, or reissued once they've been canceled, and they're no longer listed on the company's register.

In India, cancellations fall into two categories:

Section 61(1)(e) of the Companies Act, 2013 allows companies to cancel unissued shares and adjust their capital accordingly.

When the cancellation involves issued shares, shareholder and tribunal approval may be required, since ownership rights are affected.

Companies cancel shares for strategic, financial, or legal reasons:

Each reason ties back to one thing: keeping the company’s equity structure accurate and efficient.

Let’s use an example.

Example: Delta Systems Pvt. Ltd. has ₹5 crore authorized capital (5 lakh shares of ₹100 each). It has issued 4 lakh shares and plans to cancel 1 lakh unissued shares and buy back 50,000 issued shares.

Here’s the process step-by-step:

The directors meet, review the rationale, and approve the plan for cancellation or buyback. This includes recording the reason, number of shares affected, and compliance path.

If issued shares are involved, a special resolution is required under Section 66. This ensures transparency and shareholder consent.

When a reduction in paid-up capital affects shareholders or creditors, the National Company Law Tribunal (NCLT) must approve the move. The tribunal ensures no party is unfairly impacted.

After approval:

Physical shares must be destroyed, and dematerialized shares must be electronically deactivated within seven days of cancellation.

The company updates its books and share register to reflect the reduced share capital.

Whether the shares were issued or not determines their tax treatment.

According to Section 2(47) of the Income Tax Act of 1961, cancellation or buyback of issued shares constitutes a "transfer." In 2025, the Supreme Court affirmed that when share cancellation results in the termination of shareholder rights, it is, in fact, a taxable event.

This implies that if shareholders profit from the buyback or cancellation, they may be subject to capital gains tax.

In India, cancellation frequently occurs concurrently with the issuance of new shares. A business may issue new shares with revised rights, valuations, or investor terms after canceling out-of-date or redundant shares.

Sections 42 and 62 of the Firms Act of 2013 and SEBI regulations apply to the issuance of fresh shares for listed firms. Board approval, shareholder consent, valuation, and regulatory filings are all part of the process.

For example, a business might issue 50,000 new preference shares to investors after canceling 100,000 unissued shares. As a result, the capital structure remains flexible and lean.

Knowing the different kinds of shares makes it easier to forecast how a cancellation will proceed both legally and financially:

Each type demands different compliance checks to ensure no shareholder rights are violated.

Ten lakh shares are authorized, and seven lakh are issued by Nova Labs Pvt. Ltd. Investors own 40% and founders 60%. The business buys back one lakh investor shares and cancels two lakh unissued shares.

Following the procedure:

8 lakh is the authorized capital.

Shares issued: 6 lakh

The founders' share rises to 70%.

Ownership changes as a result of the overall share pool shrinking, but no new shares are issued. When businesses restructure pre-funding or consolidate ownership, this is a frequent, legal, and smart action.

Share cancellation is more than simply a formality. The goal is to adjust your capital structure to reflect the current state of your business, not its history. It can streamline your next investment cycle, simplify ownership, and clean up company data.

When handled correctly, with the appropriate forms, approvals, and correspondence, it is a sign of solid governance and financial restraint.